Introduction

In the fast-paced world of insurance, manual data entry remains one of the biggest bottlenecks to efficiency. Beacon Funding has recently made a significant leap forward by implementing an AI-powered solution to automate insurance record creation within its CRM system. This initiative exemplifies how AI-driven automation can increase productivity and streamline critical operational workflows.

The Need for Automation in Insurance Record Management

Traditionally, accountants manually entered insurance data into the CRM, such as policy numbers, expiration dates, company names, and customer details. This labor-intensive approach was time-consuming and vulnerable to human error, potentially impacting data accuracy and overall efficiency. Recognizing these challenges, the General Counsel proposed implementing an AI solution to minimize manual input in the insurance record-keeping process.

How the AI Model Works

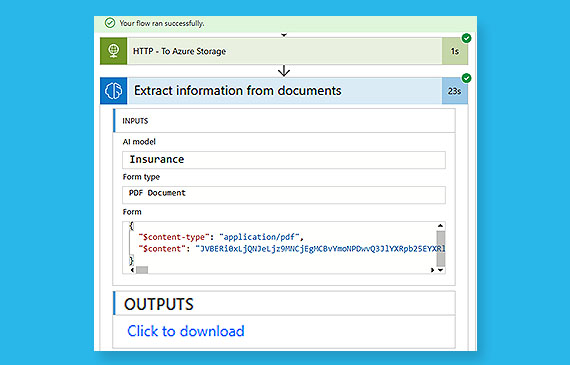

The AI model automates the extraction of key data from insurance documents. Once a document is uploaded, the AI parses it to extract crucial information, which is then uploaded to the CRM. This model is trained to accurately identify policy numbers, customer names, expiration dates, and other relevant data, eliminating the need for tedious manual entry.

The team opted for a custom-trained model, built with Azure’s suite of AI tools, to ensure the solution met the specific requirements of insurance document processing. With every processed document, the AI becomes better at understanding diverse formats and fields, making it adaptable and highly effective.

Training the AI: A Custom Approach

The development team manually tagged multiple insurance documents to create this tailored solution, teaching the AI model to recognize specific data points. This training process involved:

- Uploading Sample Documents: Initial training required documents from various insurance providers, enabling the model to learn from multiple formats.

- Tagging Data Points: Essential information like policy numbers and expiration dates were manually tagged to guide the AI on where to find and extract these details.

- Iterative Learning: The team refined the model over multiple training cycles, which allowed it to better adapt to different insurance document structures and formats over time.

This iterative training ensured the AI could handle documents from various providers, including unique formats from companies like Progressive Insurance, and consistently provide accurate data.

Ensuring Accuracy with Confidence Scoring

The AI model includes a confidence score for each extracted data point, indicating the model’s certainty about the information’s accuracy. If any score falls below 90%, the data is flagged for manual review by an expert General Counsel, who can retrain the model if needed. This blend of automation and manual oversight ensures a balance between efficiency and data integrity, ensuring that only high-quality information is entered into the company’s CRM.

Integration Challenges and Solutions

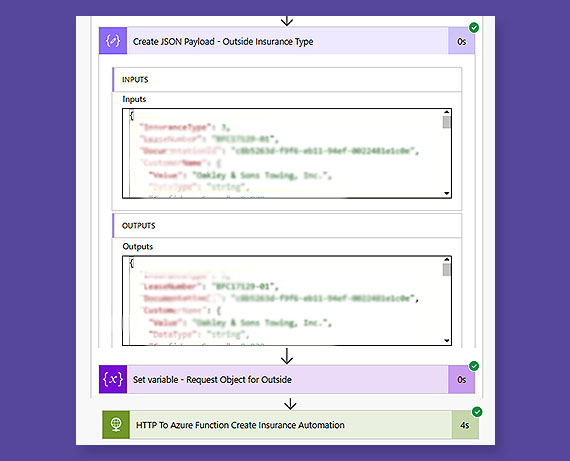

While the AI model was a powerful addition, integrating it into the company’s infrastructure posed unique challenges. Initially, the model was connected to the CRM through Microsoft’s Power Automate. However, the team encountered security and performance concerns with this setup, prompting them to consider using Logic Apps in Azure.

Logic Apps offers enhanced security and a more developer-oriented environment, making it an ideal choice for enterprise-level data handling. The development team is researching ways to migrate the model from Power Automate to Logic Apps to ensure more secure and efficient workflows.

Streamlining Operations with Workflow Automation

Integrating the AI model with the CRM system marked a major step toward streamlined insurance record management. Once a document is uploaded, the Power Automate or Logic Apps workflow automatically runs the model, extracting and parsing data and creating a new record in CRM. Including a confidence score ensures quality control, while using Azure’s function apps facilitates the seamless transfer of data between platforms.

Security and Future Considerations

Data security is a top priority at the company, especially given the sensitive nature of insurance information. The current move toward Logic Apps reflects a commitment to secure data processing and the continuous evaluation of automation tools for maximum safety and performance. With ongoing research, the company’s IT team is investigating how Logic Apps can optimize data security, particularly in sensitive information workflows.

The company is considering additional AI-driven projects that leverage similar technology to enhance operational efficiency and reduce manual workflows. Implementing this AI model may yield insights into broader applications, enabling the company to explore more automation opportunities across various departments.

Key Takeaways

- Efficiency Gains: By automating insurance record creation, the company drastically reduces manual data entry time.

- Accuracy Through AI: Custom-trained models tailored for specific document processing needs lead to highly accurate outputs.

- Balanced Oversight: The confidence score mechanism adds an extra layer of quality control, with human intervention only when necessary.

- Security-First Approach: Moving to Logic Apps in Azure showcases the company’s dedication to secure and efficient data handling.

- Future Automation Opportunities: Success in this project encourages the company to further explore automation possibilities across the organization.

The company’s journey with AI-powered automation exemplifies how targeted, thoughtful technology implementations can drive productivity and transform essential business processes. As the AI model continues to adapt and learn, the company is setting the stage for a more streamlined, efficient, and secure future in insurance record management.