Company Background

Haas Automation, founded in 1983 by Gene Haas, is the largest machine tool builder in the Western world, known for producing high-quality CNC vertical and horizontal machining centers, CNC lathes, and rotary products. Manufacturing all critical components in-house at its 1.1-million-square-foot facility in Oxnard, California, Haas employs state-of-the-art CNC machines and lean manufacturing methods to ensure quality and efficiency. While Haas provides machinery under equipment financing, the process lacked automation, leading to inefficiencies and delays.

The Challenge

The company faced significant challenges without a credit application tool. These issues underscored the necessity for an automated solution to streamline operations and enhance the customer experience.

- Manual Processes: The application process was heavily reliant on paperwork, leading to inefficiencies.

- Human Errors: Manual data entry and processing were prone to mistakes.

- Slow Turnaround Times: Approvals and processing times were lengthy, affecting customer satisfaction.

- High Operational Costs: The labor-intensive process incurred significant costs.

- Poor Customer Experience: Customers faced delays and the need for follow-up communications.

Our Solutions

Liventus developed a comprehensive online customer application tool tailored to Haas Automation’s needs. This tool automates the equipment financing application process, ensuring efficiency and accuracy.

Key Features and Functionalities:

User-Friendly Interface

The tool features an intuitive design, making navigation simple for users.

Document Management

Users can upload required documents seamlessly, and the tool includes automated document verification.

Real-Time Status Updates

Clients can track the progress of their applications in real-time, eliminating the need for follow-up calls.

How it Works

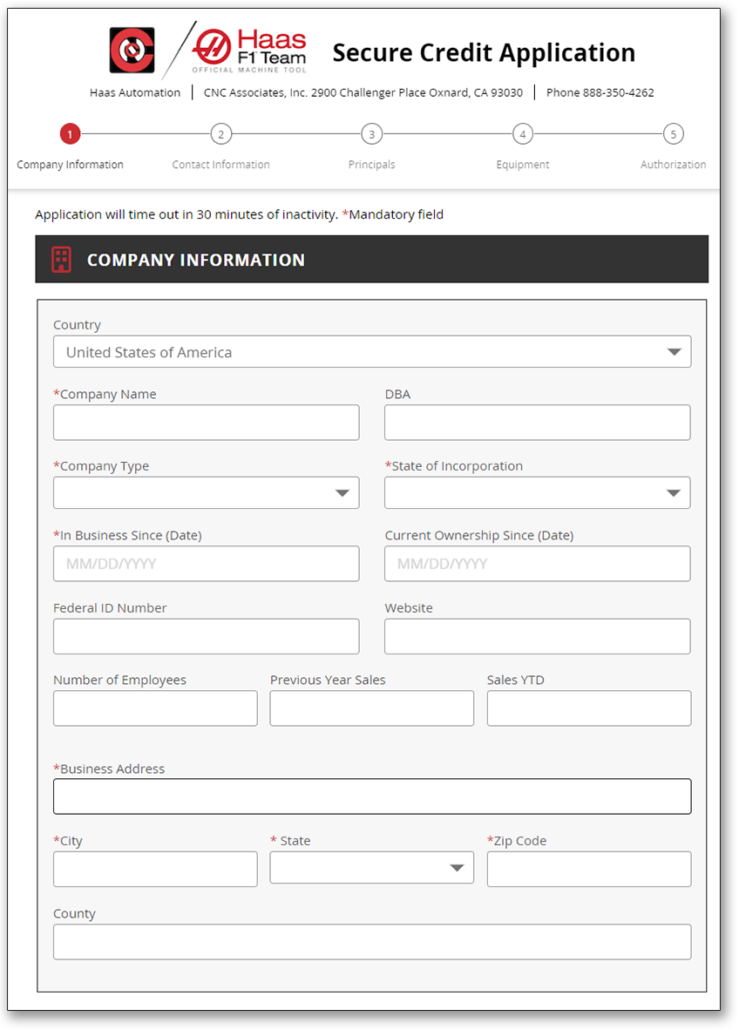

The application tool is divided into several sections, each designed to collect specific information, listed below. After entering all necessary information, users can upload documents, specify terms such as down payments and desired terms, and authorize the application by providing their name and title.

Step 1:

Collects data such as country, business name, company type, state of incorporation, years in business, gross annual income, and the company address.

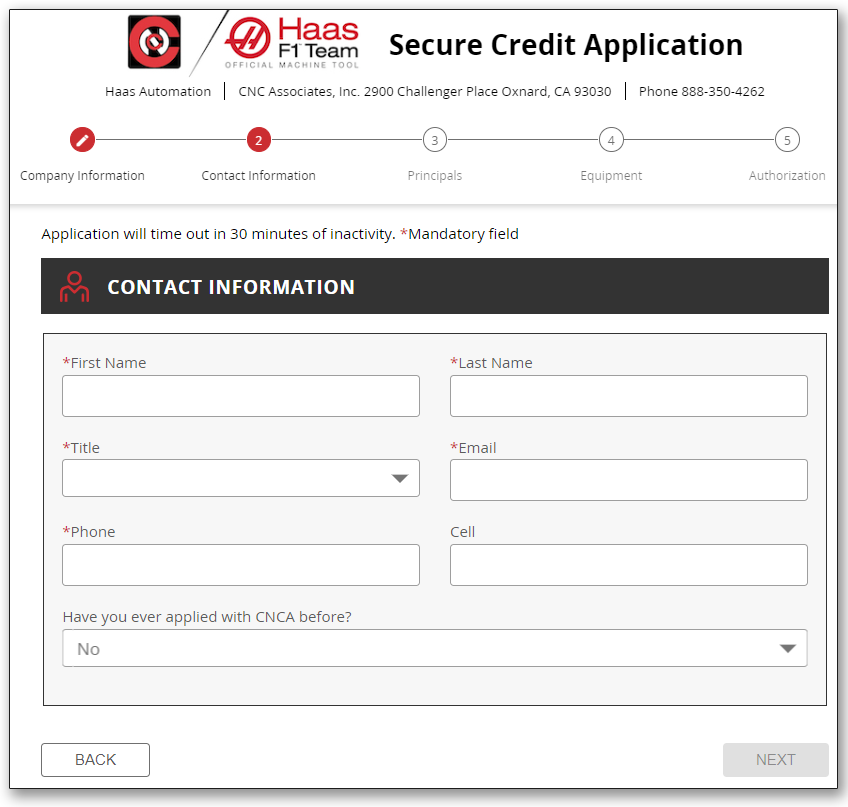

Step 2:

The application Liventus built gathers important details like first name, last name, contact title, phone number, and email.

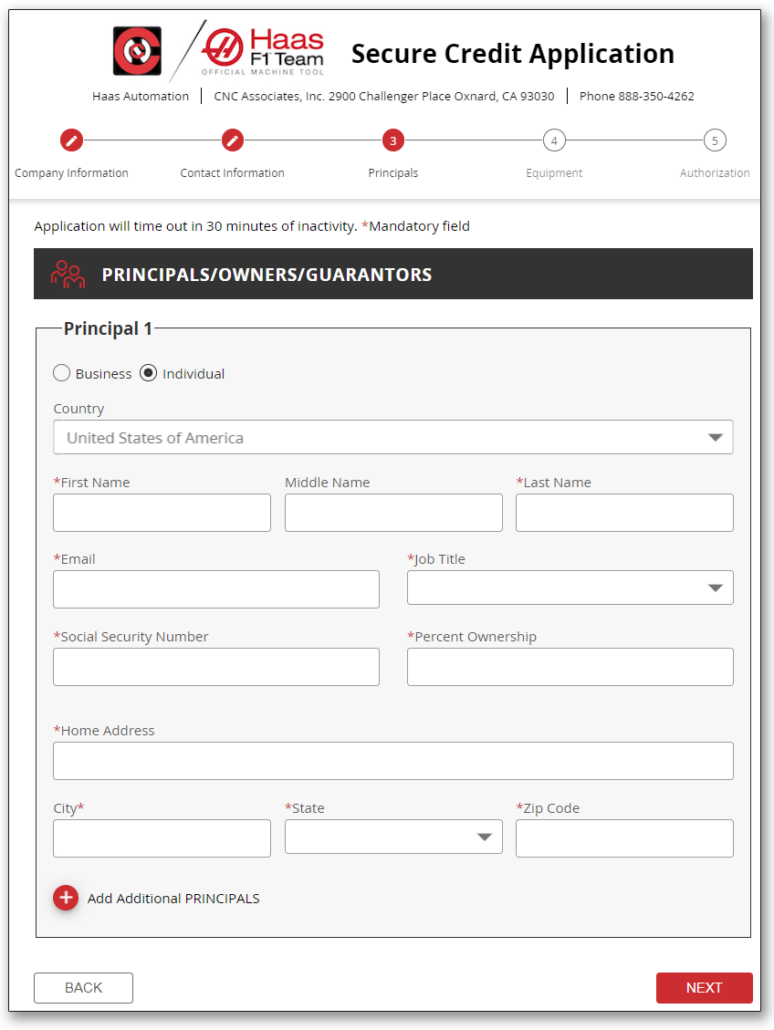

Step 3:

Requires info about guarantors, including their country, first and last names, social security numbers, titles, phone numbers, email addresses, percent ownership, and addresses.

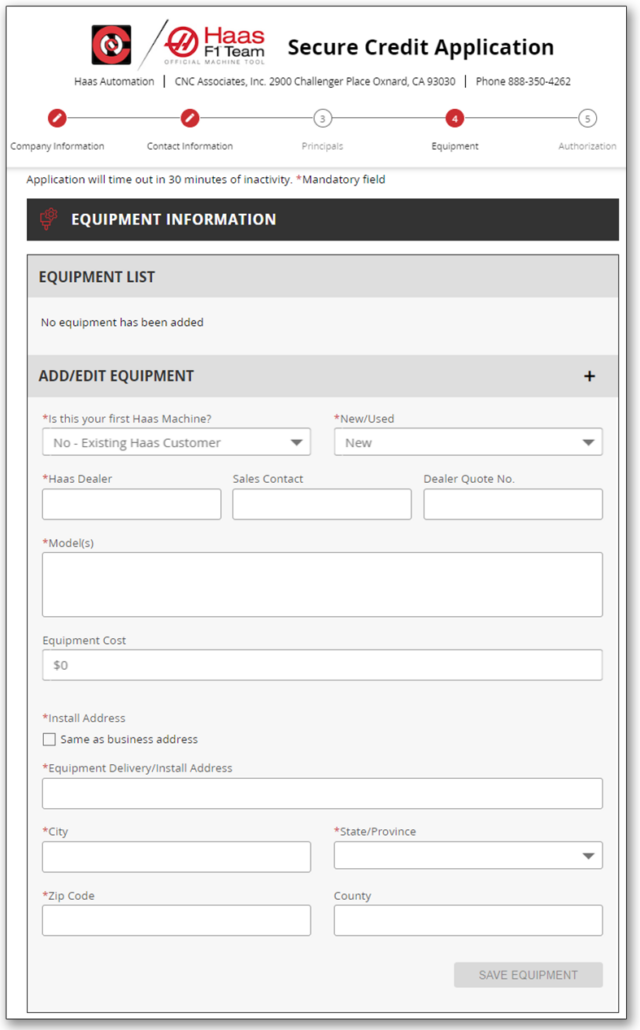

Step 4:

The application safely collects data about the asset, including dealer name, asset cost, install address, and delivery address.

Results and Impact

The implementation of the online credit application tool resulted in significant improvements for Haas Automation:

Efficiency

Streamlined application processes reduced processing time and increased efficiency.

Cost Savings

TOperational costs were reduced by up to 30% due to automation and decreased manual labor.

Customer Satisfaction

Enhanced user experience and real-time updates led to higher customer satisfaction & reduced follow-ups.

Security

The tool’s robust security features ensured data protection and compliance.

Conclusion

Liventus’ online credit application tool provided Haas Automation with a scalable, efficient, and secure solution to their equipment financing challenges. By automating the application process, Haas Automation improved operational efficiency, reduced costs, and enhanced the overall customer experience. This case study highlights the significant benefits of adopting advanced technology solutions in the manufacturing industry.